Reflections from Futures Summit 2024 🌏

Reflecting on the conversations that unfolded during the Futures Summit on the 16th and 17th of October in both Delhi and Darjeeling, one clear theme emerged:

the climate solutions we need are already here, but unlocking capital and moving it quickly is the missing piece.

The summit, hosted by Alt Carbon, brought together a diverse group of thinkers—climate finance experts, carbon project developers, and policy leaders—under one roof. What struck us the most was the growing understanding that climate change isn’t just an environmental problem, but fundamentally a financial challenge. We need to change the narrative to ensure capital moves with speed, targeting the projects that will make the biggest difference.

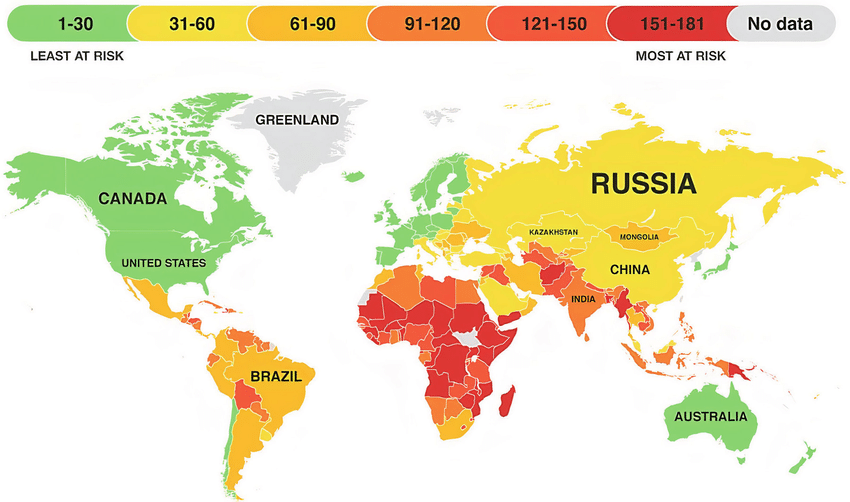

Capital and Climate: A Global Disparity

Climate is all set to enable the biggest shift of resources and capital from the Global North to the Global South— i.e. to the countries most at risk from climate change. Yet, we’re still grappling with how to make that happen.

These countries cannot be expected to compromise their development agendas for climate action. What’s needed is a balance: development and climate action must go hand-in-hand. That balance, however, depends heavily on the flow of capital from already developed nations to those still developing.

We’ve long known that climate finance is necessary, but the mechanisms to move money effectively and efficiently remain underdeveloped. This summit brought to light a simple truth: the solutions exist, but the capital hasn’t followed suit. As the ex-bank CEO of JP Morgan Chase Bank, India, P.D. Singh mentioned concepts like Green Bank and other innovative financial products could be pivotal in addressing this issue—ensuring that climate finance is not just accessible, but that it reaches the right places with minimal friction.

Carbon Project Development: The Next Frontier

The summit illuminated the emerging opportunities in carbon project development—particularly in the realm of engineered carbon removal solutions like biochar, carbon capture, and enhanced rock weathering (ERW). These engineered solutions provide more predictable results, making them attractive for large-scale deployment.

The discussion underscored a critical point: we can’t rely solely on nature-based solutions anymore. While projects like agroforestry and regenerative agriculture remain important, the future lies in engineered solutions that can scale to meet the massive carbon removal targets we face.

However, one of the challenges that is persistently on project developers’ minds: who is going to buy these credits? Project developers, especially those in emerging markets, continue to face uncertainty around the financing of their projects. The question of demand—"Where is my buyer?"—was echoed repeatedly during the summit. Without a robust buyer network, a growing demand and secure financing, these projects may never reach the scale needed to make a significant impact.

Beyond Carbon: The Ripple Effect of Climate Finance

Another key takeaway was the growing understanding that climate finance is about more than just carbon credits.

The societal benefits that stem from carbon removal projects—whether through job creation, biodiversity restoration, or social equity—are immense.

This is an area that is often overlooked but should be an integral part of how we think about climate action.

As Shirish Sankhe aptly pointed out in his discussion on Decarbonizing India, it’s not just about removing carbon from the atmosphere; it’s about creating a system where climate action drives prosperity, productivity, and employment. India, with its vast resources and rapidly growing economy, has a unique opportunity to demonstrate how climate action can be woven into the fabric of national development.

The Path Forward: Building a Global Network of Project Developers

In our view, the biggest challenge we face is scale. We need hundreds of millions of climate projects running across the world, in every zip code—from major industrial sites to small, local community efforts. The good news is that more and more project developers are entering the space, but they need support. They need buyers, they need capital, and they need infrastructure to succeed.

For companies like Climes, this is where we can make a difference. Our role is to build the climate finance infrastructure that makes it easy for enterprises, institutions, and individuals to measure, manage, and act on their carbon impact. We are in the business of enabling climate action at scale—by ensuring that the capital moves to the right projects, at the right time, and with the transparency needed to ensure long-term impact.

2024 will be a turning point, as we push toward gigaton-scale carbon removal. But we need to move quickly.

The clock is ticking, and we can no longer afford to wait for slow cycles of capital deployment.