Carbon Markets 3.0: Building healthier incentive systems to close the massive climate finance gap

Nature is a gift we have received in abundance. And largely for free. There are few things of value in the world that fall into the same category of plentiful, universally loved, and which come at a low cost. Yet, we have never been able to price nature. Without pricing it, we will never understand how to truly value it and the collective efforts that are needed to preserve it. So, how do we design this better?

This is the problem carbon markets have sought to address. Here is an opportunity to turn an unfolding “tragedy of the commons” into a “victory of the commons.” And in doing so, incentivize further financial and human capital into the development and preservation of more nature-based projects. However, for several reasons, we’re not yet where we need to be. Quality of projects, transparency of capital flow, accountability of stakeholders involved, and volumes of capital unlocked - all fall extremely short of what the planet needs to have a shot at a cleaner, fairer, better, and more resource-efficient future.

The added turmoil from hard-hitting, investigative, and factual stories published in 2023 by The Guardian, The New Yorker, John Oliver, and DownToEarth has only compounded the general skepticism about the market-based systems built for carbon financing over the last 15 years. However, this is not necessarily a bad thing.

More spotlight and harder questions from unshakable journalists and discerning end buyers of carbon credits will only serve to identify still-existent gaps, and bad actors, and improve the overall system.

This is how we will build healthier incentive systems to close the massive climate finance gap. Three steps forward, and one step back. Sometimes two. And that’s okay. Net-net, we are now on the cusp of what I like to call “carbon markets 3.0.” Drastically improved, cleaner, healthier, and more aligned with the building of a truly regenerative global economy.

Of all available solutions, Nature-Based Solutions (NBS) are the key to driving large-scale planetary impact. Nature has already given us a buffet of effective solutions to choose from - agroforestry, regenerative agriculture, mangrove plantations, seaweed and kelp, wetland restoration, and so on. No R&D, and no time-to-market-readiness problems. The problem we do have to solve for now is incentivizing large-scale NBS project financing and development across the globe, particularly in the global south.

Here are 3 moves that we feel are lining up to play out in the evolved and improved “carbon markets 3.0.”

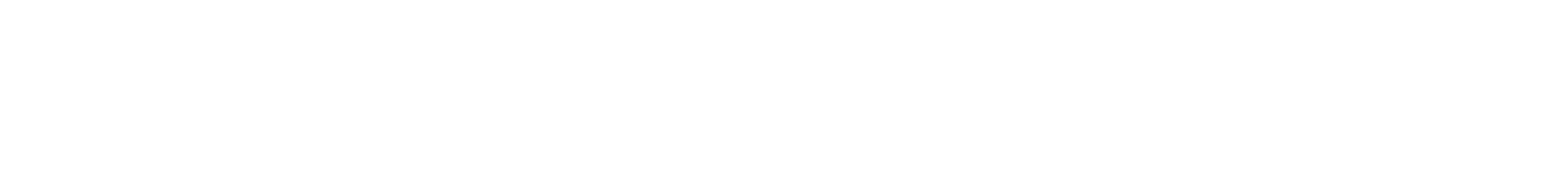

1. Clear segmentation of carbon projects within

2. Growing wave of interest in NBS

A growing wave of interest in NBS, following companies like Apple and Mars. Nature-based project development has massive potential across solutions and geographies, at cost curves that make sense. It also creates environmental, social, and economic impact that justifies every additional dollar spent on a corporate balance sheet.

3. Move away from the spot-trading market

A move away from the spot-trading market towards more long-term pre-financing arrangements for captive NBS carbon project development- similar to the captive power plant development model. End buyers are becoming more interested in seeing the project solve their residual carbon emissions over the next decade or two, and having it become a part of their value chain. Trust in unknown developers building and selling credits from a faceless project is at an all-time low, and rightly so. Long-term pre-financing of large-scale projects that solve for the end users of those credits, is an opportunity waiting to explode.

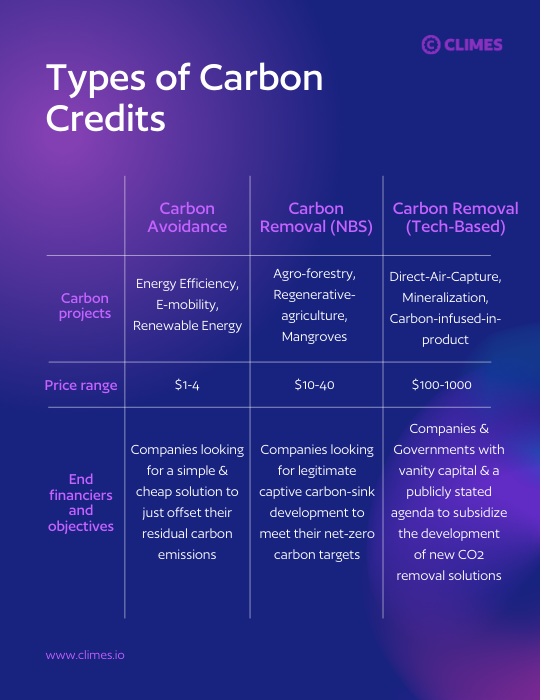

Over the last 15 years, carbon markets have grown and shrunk many times over. And with each cycle, they have gotten closer to the truth of the model we need for our planet. Today, the voluntary carbon market remains our most viable channel for funding carbon removal and avoidance projects that will be essential for reaching the Paris climate goals. 2023 and beyond will emerge as the single best time this century to be building high-quality NBS projects that can solve climate change, at the speed and scale we collectively need.

Get in touch with us to know more about financing high-quality nature-based solutions and to explore potential collaborations: carbon-finance@climes.io